If you’re considering starting an online business or website, one of the first decisions you must make is choosing between different business structures.

The main options include sole proprietorship, partnership, corporation, and limited liability company (LLC). Each one has its own pros and cons, depending on your specific needs and goals.

In this guide, we’ll focus on the LLC option and explain what it is, what its benefits are, the steps to forming an LLC, and what to consider after the formation process (in the United States and Canada).

By the end of the article, you’ll know if an LLC is the right choice for your business. And, you’ll be ready to form your LLC and keep it running smoothly while complying with federal, state, and local laws in the United States.

Let’s dive in.

Please note that the information provided in this article doesn’t constitute financial or legal advice. It’s always recommended to seek the guidance of a professional when it comes to forming a company and ensuring compliance with your local regulations.

- What Is an LLC (Limited Liability Company)?

- The Importance and Benefits of Forming an LLC

- Forming an LLC in the United States in 7 Simple Steps

- Key Differences Between LLC Formation in the US and Business Incorporation in Canada

- Considerations After Forming an LLC in the United States

- 3 Tips for Forming and Running a Successful LLC

What Is an LLC (Limited Liability Company)?

An LLC, or Limited Liability Company, is a type of business entity that combines some of the features of a corporation, like limited liability, and some of the features of a partnership or sole proprietorship, like pass-through taxation (more on that later).

You create an LLC by filing a document called “articles of organization” with the state where the business is located. The owners of an LLC are called members, and they can be individuals, corporations, or other entities.

The Importance and Benefits of Forming an LLC

Forming an LLC can provide several benefits for your business, whether it’s an online or a brick-and-mortar business. Here are some of the most important benefits of forming an LLC.

It’s a Separate Legal Identity

LLCs are separate legal entities from their members. This means an LLC can enter into contracts, own property, sue and be sued, and have its own tax obligations.

However, unlike a corporation, an LLC doesn’t have shareholders or a board of directors. Instead, members can decide how to manage and operate the business according to their own agreements.

You Benefit From Limited Liability

But does an LLC protect your personal assets? Yes! One of the primary reasons business owners opt for an LLC structure is the personal liability protection it offers. Limited liability means that, in most cases, your personal assets are kept separate from the company’s liabilities.

In simple terms, you aren’t personally responsible for the actions or debts of the business unless you have personally guaranteed them or committed fraud or negligence.

For instance, if your LLC faces debt or legal challenges, only its business assets can be seized — your personal assets, like your online savings account, remain untouched. This is especially reassuring for entrepreneurs who’ve recently saved a substantial amount or want to maintain a strong personal financial profile.

An online savings account is an excellent tool for budding entrepreneurs as it offers higher interest rates than traditional savings, ensuring that your personal funds continue to grow as you navigate the business world. That’s why many entrepreneurs save money in this type of account while protecting it from possible liabilities by forming an LLC.

LLCs Can Last Forever

Unlike other business entities, such as partnerships or sole proprietorships, an LLC can have a perpetual existence. In other words, you can continue operating even if one or more members die, retire, or leave the business.

How? Transferring your ownership interest in the LLC to someone else without affecting its continuity.

You Can Choose Different Management Structures

In a member-managed LLC; all members have equal rights and responsibilities in making decisions for the business. This is a common choice for most small businesses.

In a manager-managed LLC, one or more members are appointed as managers with the authority to make decisions for the business. In contrast, the other members are passive investors who don’t participate in the management.

An LLC allows you to choose how to manage and run your business through an LLC operating agreement.

Tax Flexibility and Efficiency

An LLC also offers more flexible tax rules and tax efficiency for your business. By default, LLCs are taxed as pass-through or flow-through entities. In this case, the company’s profits and losses are passed through to members. These can later report them on their personal income tax returns, avoiding double taxation.

An LLC can also be taxed as an S-corp, saving money on self-employment taxes (Social Security and Medicare) by paying business owners a reasonable salary and distributing the remaining profits as dividends.

The owners pay self-employment taxes, but they don’t pay a tax on dividends. S-corps may also qualify for a 20% deduction for qualified business income.

Alternatively, an LLC can be taxed as a corporation or C-corp and pay corporate income tax if it prefers to retain some of its earnings in the business or take advantage of certain tax deductions and credits.

Forming an LLC in the United States in 7 Simple Steps

The following sections cover the seven essential steps to form an LLC in the United States.

Reminder: Each state’s guidelines are unique, underscoring the importance of navigating the specific requirements that apply to your location.

For example, in Florida, the formation follows a specific sequence of steps, ensuring compliance and efficiency. Each step is crucial for a successful establishment.

So, while these are generalized steps for forming an LLC in the United States, pay special attention to any special regulations with your state of incorporation.

Step 1: Choose a Name and Register It

The LLC formation journey starts with choosing a name for your business. The name should reflect your brand identity and comply with your state’s rules. It must also be unique and distinguishable from existing businesses in your state.

According to the latest domain statistics, there are over 350 million registered domain names globally, which underscores the importance of selecting a unique and memorable business name early in the process.

After choosing a name for your LLC, you must register it with your state’s Secretary of State or equivalent agency. You may also need to reserve your name for a certain period before filing your articles of organization.

The specific filing fees and procedures for registering and reserving your name vary by state, so you should check your state agency’s website for more information.

At this stage, it’s a good idea to register for a website domain name as well so you’re better prepared for your next step, which is creating a website to represent your new business.

Step 2: Choose a Tax Structure

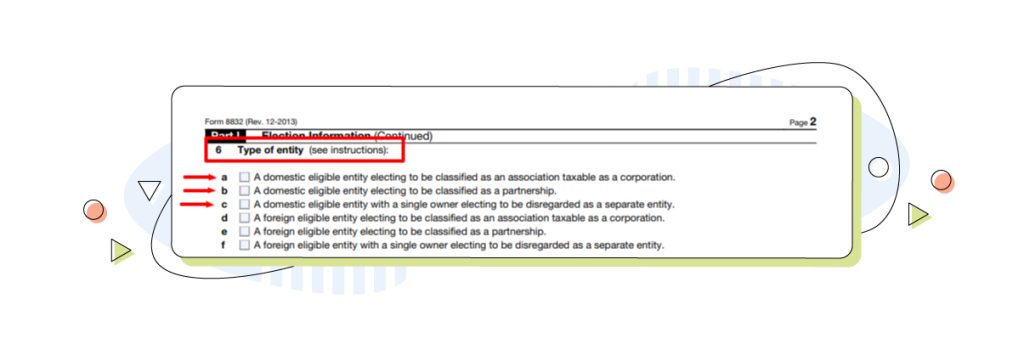

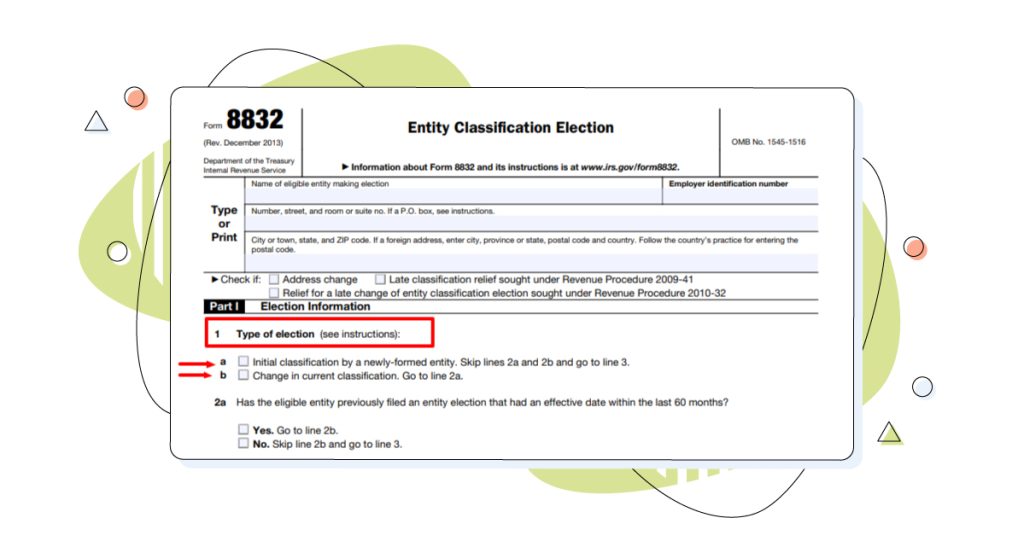

After choosing the name, you must choose a tax structure for your business. As mentioned above, an LLC can be taxed as an S-corp or a C-corp. You can choose this by filing a form with the Internal Revenue Service (IRS) called Form 8832, Entity Classification Election.

You can also change your tax structure later if your circumstances change.

If you don’t file Form 8832, the IRS will automatically classify your LLC as a pass-through entity based on the number of members (single-member LLCs vs. multi-member LLCs).

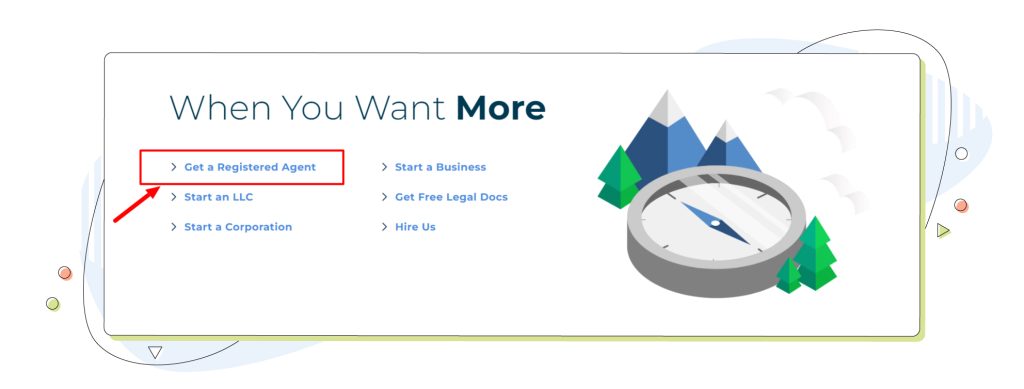

Step 3: Find a Registered Agent

All LLCs must have a registered agent by law. A registered agent is a person or entity that agrees to receive legal documents and notices on behalf of your LLC.

Among other conditions, they must have a physical address in the state where you’re forming your LLC and must be available on business days during regular business hours.

You can choose one of the LLC’s members to act as the registered agent or hire a professional service to act as one for you.

Step 4: Set Up an LLC Operating Agreement

An operating agreement is a legal document that outlines the rules and regulations for running your LLC. It covers topics such as the roles and responsibilities of the members, the management structure, the voting rights, the profit and loss distribution, the dispute resolution process, and the dissolution procedure.

An operating agreement isn’t required by law in most states, but it’s highly recommended to have one for several reasons:

- Clarifying expectations and obligations helps avoid conflicts and misunderstandings among members.

- It helps to protect the limited liability status of members by showing that they are operating as a separate entity from their personal affairs.

- You can customize your business according to your specific needs and goals.

Step 5 Fill Out and File the LLC Articles of Organization Form

The fifth step in forming an LLC is to fill out a copy of your state’s LLC organization form. Submitting this document officially creates your LLC and registers it with the state.

It contains basic information about your business, such as the following:

- Business name

- Address

- Purpose

- Duration

- Registered Agent

- Members

- Managers

You’ll need to fill out the form according to the instructions and requirements of your state. You may also need to attach additional documents or information, including your name reservation certificate, tax election form, and, in some cases, proof of publication of an LLC formation notice (read below).

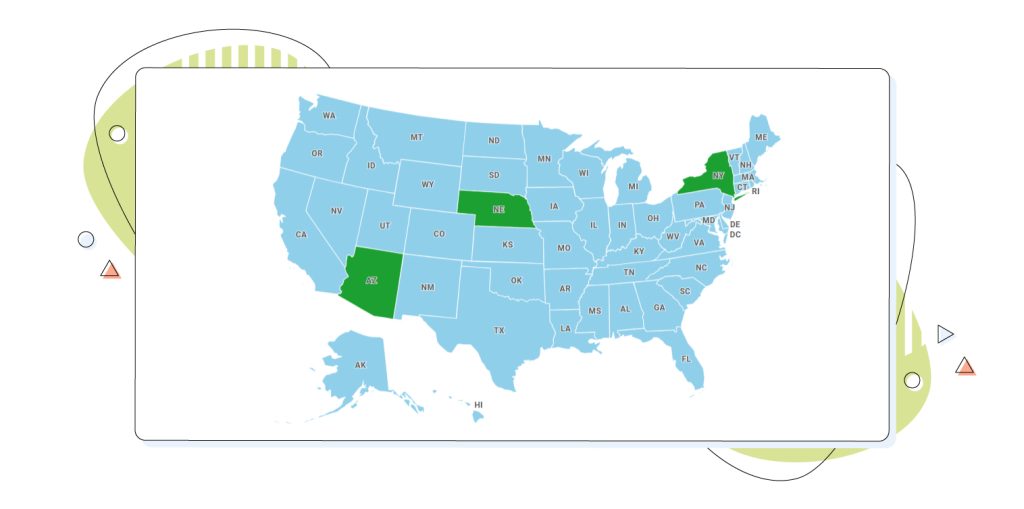

Step 6 Publish a Notice in an Approved Newspaper (Only for AZ, NE, and NY)

If you’re registering an LLC in the states of Arizona, Nebraska, or New York, you’re required to publish a notice of formation or intent to form an LLC in an approved general-circulation newspaper.

This requirement aims to inform the public and potential creditors about your new business. The notice must contain information about your LLC, including its name, address, registered agent, purpose, duration, and members or managers.

Depending on the state, the notice must be published a specific number of times and within a certain time frame after filing your articles of organization. You’ll also need to obtain proof of publication from the newspaper and submit it to the state.

Step 7: Obtain Business Licenses and Permits for Your State

The seventh and final step in forming an LLC is to obtain the necessary business licenses and permits for your state and local jurisdiction.

Depending on the nature and location of your physical or online business, you may need to comply with various federal, state, and local regulations and requirements to operate in the US.

For example, you may need to register for sales tax, obtain a zoning permit, or apply for a professional license.

Key Differences Between LLC Formation in the US and Business Incorporation in Canada

Setting up an LLC in the United States and a similar business structure in Canada involves different processes, regulations, and implications.

Why? There are differences in the legal and tax systems between the two countries. Here are some key differences:

1. Business Structures

United States: The LLC is a popular business structure for small to medium-sized businesses.

It provides limited liability protection to its owners (called members), pass-through taxation (unless the LLC elects to be taxed as a corporation), and flexibility in management.

Canada: Canada doesn’t have an exact equivalent to the LLC. The closest entity would be a provincial or federal corporation. Like an LLC, a Canadian corporation provides limited liability protection.

For tax purposes, a Canadian-controlled private corporation (CCPC) status can offer tax advantages similar to pass-through taxation if Canadian residents control the corporation.

2. Formation and Registration

United States: LLCs are formed at the state level. Each state has its own set of rules and procedures for forming an LLC, typically involving filing articles of organization with the state’s Secretary of State office or equivalent and paying a filing fee.

Canada: Corporations can be registered federally or provincially. Federal incorporation allows you to do business across Canada, while provincial incorporation limits your official business operations to the province of registration. The process involves filing Articles of Incorporation with the appropriate federal or provincial body and paying the necessary fees.

3. Maintenance Requirements

United States: LLCs must comply with state-specific annual or biennial reporting requirements and pay fees or franchise taxes to maintain good standing.

Canada: Corporations must file annual returns with the government. If federally incorporated, maintain an updated record of directors, addresses, and other corporate information with Corporations Canada.

4. Taxation

United States: LLCs are typically taxed as pass-through entities by default, meaning the company itself doesn’t pay federal income taxes. Instead, profits and losses pass through to the personal tax returns of members.

Canada: A corporation pays taxes on its income at the corporate level, and shareholders pay taxes on dividends received (double taxation). However, integrating corporate and personal tax systems aims to alleviate this. CCPCs benefit from lower tax rates on active business income up to a certain limit.

5. Ownership and Residency Requirements

United States: There are generally no citizenship or residency requirements for LLC members.

Canada: For federal corporations, there’s a requirement that at least 25% of the directors be Canadian residents. Some provinces have similar or even more stringent residency requirements for directors.

6. Other Considerations

United States: Each state has its own nuances, such as California’s gross receipts tax or Texas’ franchise tax, which can affect the desirability of forming an LLC in that state.

Canada: If you incorporate federally in Canada, you must also register in each province where you do business, which can add to the complexity and cost.

TL;DR: while both the US LLC and the Canadian corporation offer limited liability protection, the specifics of formation, taxation, and ongoing compliance differ significantly due to the distinct legal and tax frameworks of each country.

When in doubt, consult with legal and tax professionals in your respective country when forming a business entity.

Please note that the information provided in this article doesn’t constitute financial or legal advice. It’s always recommended to seek the guidance of a professional when it comes to forming a company and ensuring compliance with your local regulations.

Considerations After Forming an LLC in the United States

After you have successfully formed your LLC, there are some essential considerations that you need to keep in mind to maintain and grow your business.

Get Your Employer Identification Number (EIN)

An EIN, also known as a Federal Tax Identification Number (FTIN), is a nine-digit number that identifies your business for tax purposes. You’ll need an EIN to hire employees, open a business bank account, apply for business loans or credit cards, or file certain tax forms.

Open a Business Bank Account

One of the best practices for running an LLC is to keep your personal and business finances separate. This helps to protect your limited liability status, simplify your accounting and bookkeeping, and improve your credibility and professionalism.

To do this, you must open a business bank account for your LLC. You can then link your account to different payment gateways to streamline online transactions.

Depending on the bank, you must provide some documents and information, such as your EIN, articles of organization, operating agreement, personal identification, and an initial deposit to open a business account.

Use Your New LLC’s Name Across the Board

Another best practice for running an LLC is consistently using your new LLC name across all aspects of your business, e.g., as part of the footer on all your website’s pages. Here’s a simple example from Wordable.

These small details help to establish your brand identity, increase your visibility and recognition, and avoid confusion and legal issues.

Keep Your LLC Active

The last consideration for running an LLC is to keep it active and in good standing with the state. In other words, you must comply with the ongoing requirements and obligations that apply to your LLC, such as:

- Filing annual reports

- Paying annual fees

- Renewing licenses and permits

- Updating information

- Keeping records

- Holding meetings

- Filing taxes

If you fail to meet these requirements and obligations, you may face penalties, fines, suspension, or dissolution of your LLC.

Build A Website

For beginners forming their own company, creating a website seems like a challenging task. But fret not, since HostPapa is meant to help ease you into the world of high-performance web hosting with outstanding web solutions for businesses.

And if stepping into the WordPress realm seems tough, there’s always the professional web designer’s help via the Do It For Me service, a complete solution which takes your website from a sketch and brings it to the real world.

3 Tips for Forming and Running a Successful LLC

To wrap things up, here are three tips that can help you form and run a successful LLC:

Tip 1 Maintain Good Credit

While considering your LLC’s finances, it’s vital to highlight the importance of maintaining good credit, both personally and for your LLC.

The latest statistics on bad credit reveal that businesses with poor credit ratings find it challenging to secure loans or attract potential investors. This makes tracking and improving your LLC’s credit score a top priority.

Furthermore, even though an LLC separates personal and business finances, having a solid personal credit history can pave the way for smoother transactions and trustworthiness in the business world.

Tip 2 Get Business Insurance

Business insurance is critical to protecting your business from potential risks and liabilities. Business insurance can cover various aspects of your business, such as:

- Property damage

- Liability claims

- Business interruption

- Employee injuries

- Cyberattacks

- Lawsuits, and more.

Depending on the particular insurance provider, you can choose from different types of business insurance, such as general liability insurance, professional liability insurance, property insurance, workers’ compensation insurance, and others.

Tip 3 Start Running Your Business Right Away

Our final tip is to start your business immediately if you haven’t already. You don’t need an LLC to start a business, so you don’t have to wait for everything to be approved if you decide to form an LLC.

In Summary

Forming an LLC is an excellent option for starting an online business or website. It offers several benefits, including limited liability, tax flexibility, management flexibility, and perpetual existence. It also involves a simple and straightforward seven-step process.

After forming an LLC, there are some essential considerations that you need to keep in mind to maintain and grow your business, such as:

- Getting tax advice

- Setting an EIN

- Opening a business bank account

- Using your new LLC name across the board

- Following ongoing federal, state, and local requirements and obligations.

Although this sounds like a lot of work, it’ll help save you headaches down the road. Establishing an LLC gives your business additional credibility and protects your personal assets if anything were to go wrong.

So, are you ready to start your first LLC? Here’s to your success.

Author Bio:

Ryan Robinson. I’m a blogger, podcaster and (recovering) side project addict who teaches 500,000 monthly readers how to start a blog and grow a profitable side business at ryrob.com.